About Us

Our team includes renowned academics and industry practitioners who bring decades of expertise to Parala’s quantitative analysis and investing approach.

Our founding partners have leveraged insights from the field of finance and financial econometrics to create an intelligent investment methodology and technology that helps investors deliver better outcomes and do so at scale.

AlphaPredictor® is the name of our investment technology which we are making available to our clients.

How to work with us?

Data and Research License

Interested in asset allocation, mutual fund, market or sector forward-looking rankings? If it can be standardized in a research report or data package, then we can use AlphaPredictor® to generate what you need and make it available to you via a Data and Research License.

Consulting Solutions

Do want to build your own model portfolios, add a service, solve a problem or even create some research content for your own though leadership and marketing efforts? If so, then you can leverage our expertise and AlphaPredictor® to deliver what you need.

Technology License

Do you want to access AlphaPredictor® directly for analysis, forecasting, portfolio building, risk management and/or reporting? If so, then a technology license is the way to go and it can be set up for one or more AlphaPredictor® modules that best fit your needs.

Our Blog

Latest blog posts

From research about asset classes, sectors and peer groups to articles about how to get the most out of AlphaPredictor®, you’ll find our latest thoughts here.

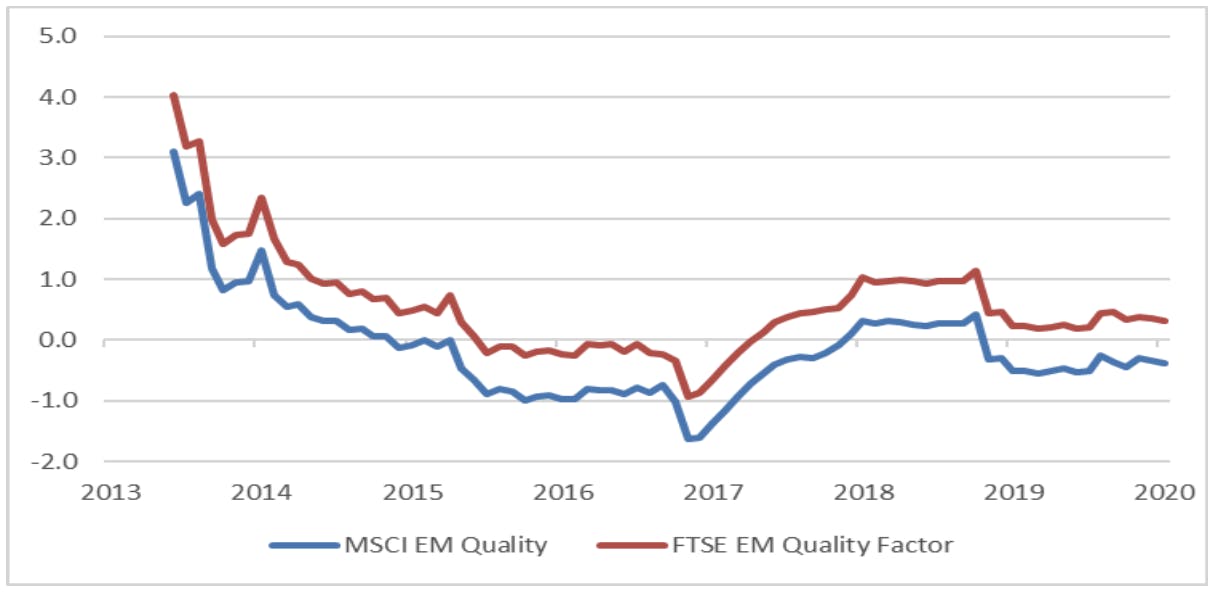

Emerging Market Equity Risk Factors Sensitivity to the Business Cycle

It is common knowledge that the business cycle moves through stages in which it expands, contracts and recovers and these stages have an influence on asset prices.

Parala

March 14, 2023

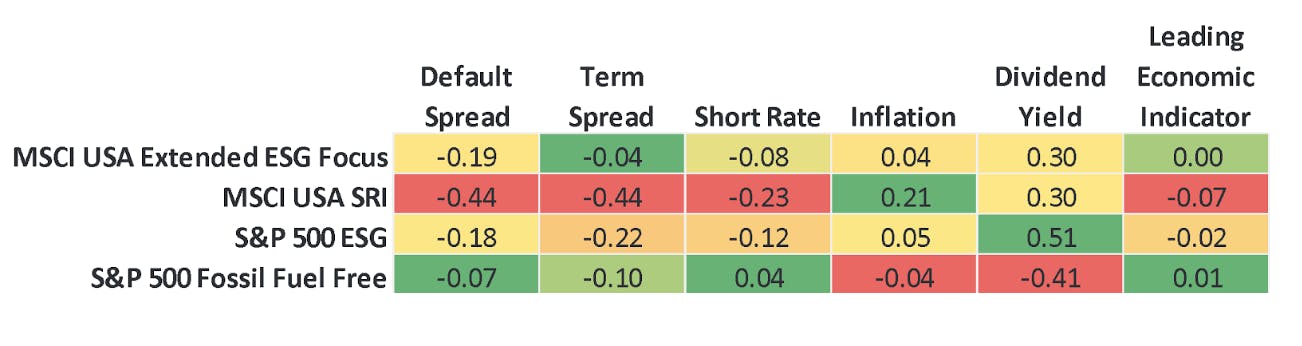

ESG and SRI factor sensitivities to the business cycle and differences across the most popular ETFs

In this article we take a look at some of the largest passive US and Global ESG and SRI ETFs with one or two additional ones included for variety.

Steven Goldin

March 14, 2023

Asset allocation trends – May 2024 update

The importance of getting the asset allocation decisions right has long been engrained in the thinking of investors and financial professionals.

Parala

June 17, 2024